Buying a House

Planning to buy a house in Kirkcaldy, Fife or the surrounding areas? Fords Daly Legal provides expert conveyancing support throughout the Scottish house buying process, from your first offer to the day you collect your keys.

Buying a home in Scotland follows a distinct legal process that differs significantly from England and Wales. Understanding how the Scottish system works – and having experienced local solicitors on your side – makes all the difference between a smooth purchase and a stressful experience.

Whether you’re a first-time buyer excited about getting on the property ladder, a growing family moving to a larger home, or purchasing an investment property, Fords Daly Legal guides you through every stage with clear advice in plain English

Quick Navigation

How Buying a House in Scotland Works

The Scottish house-buying process is unique, and it’s essential to understand the key stages before making an offer.

Making Your Offer

Once you’ve found the right property in Kirkcaldy, Glenrothes, Dunfermline or elsewhere in Fife or across Scotland, your solicitor prepares and submits a formal written offer to the seller’s solicitor. In Scotland, you must have a solicitor to make a formal offer. Whilst the seller’s estate agent can indicate your offer is acceptable, they cannot issue a formal acceptance.

Negotiating The Missives

After your initial offer, there follows an exchange of formal legal letters called missives. During this negotiation period, either party can still withdraw without penalty. This stage typically addresses the purchase price, entry date, what’s included in the sale, and any conditions you want to attach.

Concluding the Contract

Once both sides agree on all terms, missives are “concluded,” and the contract becomes legally binding. From this point forward, both you and the seller are committed to the transaction. This differs from England, where contracts are binding only at the much later “exchange of contracts” stage.

The Conveyancing Process

After missives are concluded, we carry out the detailed conveyancing work to prepare for settlement. This includes conducting thorough property searches (such as local authority searches, environmental searches, and coal mining reports where applicable), examining the title in detail to identify any burdens, restrictions or issues, liaising with your mortgage lender to ensure all their conditions are met, and preparing the legal documents required for settlement – including the disposition that will transfer ownership to you. We also handle all anti-money laundering checks and verify your source of funds as required by the Law Society of Scotland. Throughout this stage, we keep you informed of progress and raise any concerns with the seller’s solicitor to ensure everything is in order before your Date of Entry.

Settlement and Registration

On the agreed settlement date, which, in Scotland, we call the “Date of Entry”, we transfer the purchase funds and ask the seller’s solicitor to authorise the keys to you. We will also receive the disposition transferring ownership to you and will register your title to the property in the Land Register.

We explain each stage as it happens, so you always know what to expect next and when you can start planning your move.

What Our House Buying Service Includes

When you instruct Fords Daly Legal for your property purchase in Scotland, we handle all legal aspects from start to finish:

Expert Legal Representation

We act as your legal representative throughout the transaction, protecting your interests at every stage. From drafting your initial offer through to post-settlement registration, we ensure all legal aspects are handled correctly and efficiently.

Thorough Due Diligence

We meticulously examine the title deeds, review the Home Report, and conduct all necessary property searches. We identify and investigate any issues that could affect your purchase – including burdens, restrictions, rights of way, maintenance obligations, or planning concerns – and advise you clearly on the implications.

Clear, Proactive Communication

You’ll never receive impenetrable legal jargon from us. We explain everything in plain English, respond promptly to your questions, and keep you informed throughout. We don’t just report problems – we anticipate them and work to resolve them before they cause delays.

Mortgage and Lender Liaison

We coordinate directly with your mortgage lender, review your mortgage offer for any onerous conditions, ensure all lending requirements are met, and arrange for funds to be available on your Date of Entry.

Complete Documentation Service

We prepare all legal documents required for your purchase, including the disposition (which transfers ownership to you), any Standard Securities for your lender, and handle all Land and Buildings Transaction Tax matters with Revenue Scotland.

Local Market Knowledge

Our experience handling hundreds of property purchases across Fife and beyond means we understand local market conditions, know the solicitors and estate agents in the area, and can advise on competitive yet realistic offer strategies for Kirkcaldy, Glenrothes, Dunfermline, and throughout Fife.

Advice for Your Situation

Every property purchase is different, and we tailor our approach to your circumstances.

First-Time Buyers

Buying your first home in Scotland can feel overwhelming, especially if you’re navigating mortgage arrangements, Help to Buy schemes, or LBTT (Land and Buildings Transaction Tax) for the first time. We take the time to explain each step, help you budget for all costs, and ensure you understand your obligations as a new homeowner.

Home Movers

If you’re selling one property while buying another in Kirkcaldy, Fife or beyond, timing and coordination become critical. We work closely with the solicitor on the other side of each transaction to align dates, manage potential delays, and protect you if either transaction encounters problems.

Additional Property Buyers

Purchasing a second home, buy-to-let investment, or holiday property involves different tax considerations and often stricter lending criteria. In addition to the normal LBTT applying, if the price of the property you are buying exceeds £40,000, you will need to pay the Additional Dwelling Supplement (ADS). The ADS applies regardless of whether LBTT is payable.

Cash Buyers

Buying without a mortgage simplifies some aspects but doesn’t eliminate the need for thorough legal due diligence. We ensure you continue to benefit from comprehensive searches and title examination to protect your investment.

Buyers with Property Chains

If your purchase depends on selling your current home, we can include this as a condition in your offer. We advise on how this affects your negotiating position and what happens if your sale falls through.

Why Choose Fords Daly Legal for Your House Purchase

Clients across Kirkcaldy, Glenrothes, Leven, Dunfermline and throughout Fife choose Fords Daly Legal because:

Deep Local Knowledge

We’ve handled hundreds of property purchases across Fife and beyond. We understand local property market conditions, know the area solicitors and estate agents, and can advise on neighbourhood-specific considerations – from school catchment areas to future development plans.

Proactive, Not Reactive

We don’t wait for problems to arise. We anticipate potential issues, address them early, and keep your transaction moving forward. If delays occur, we take action to resolve them rather than simply reporting them to you.

Clear Communication as Standard

You’ll never receive impenetrable legal jargon from us. We explain everything in plain English, return calls and emails promptly, and ensure you understand your position at each stage. Many clients tell us this is what they value most.

Competitive, Transparent Pricing

We provide clear fee quotes upfront with no hidden charges, and we’re happy to discuss our pricing before you instruct us. Our fees are competitive for the Kirkcaldy and Fife area, and we believe they represent excellent value for the comprehensive service we provide.

Established Track Record

Fords Daly Legal has been serving the local community for many years. Our experience means we’ve handled virtually every type of transaction and problem that can arise, and we know how to resolve issues efficiently.

Member of Professional Bodies

We are regulated by the Law Society of Scotland, giving you the protection and peace of mind that comes with working with qualified, insured solicitors.

Common Costs When Buying a House in Scotland

Beyond the purchase price itself, budget for these additional costs:

- LBTT (Land and Buildings Transaction Tax) – Scotland’s equivalent of stamp duty, calculated on a sliding scale. First-time buyers don’t pay LBTT until the price exceeds £175,000.

- Legal Costs – Our professional fees (plus VAT) for the conveyancing work, plus outlays

- Mortgage arrangement fees – Charged by some lenders

- Home Report fee – Usually paid by the seller, but occasionally, buyers commission updated surveys

- Moving costs – Removal firms, van hire, storage

- Buildings Insurance – If your mortgage lender requires it

- Additional Dwelling Supplement (ADS) – if you are buying a second residential property

We provide a detailed breakdown of likely costs when you instruct us, so there are no surprises.

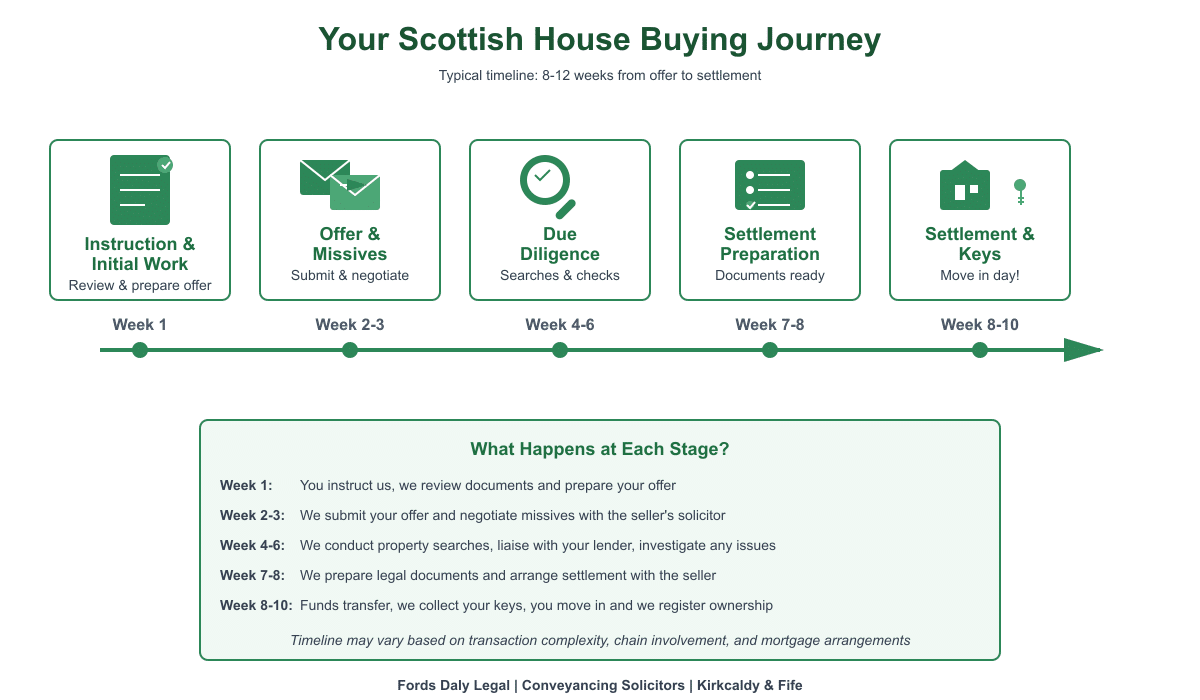

Timeline: How Long Does Buying a House in Scotland Take?

While every transaction is unique, here’s a typical timeline for buying a house in Kirkcaldy or elsewhere in Fife. Most property purchases in Scotland complete within 8-12 weeks from acceptance of offer to Date of Entry, though this can vary considerably based on complexity.

Week 1: Instruction and Initial Work

You instruct us, we review the Home Report, discuss the purchase price with you and prepare your offer. We also conduct initial Anti-money laundering checks as required by our regulator, the Law Society of Scotland. Please note that in addition to photo ID and address verification, we will also need proof of source of funds for your contribution towards the purchase price. Where you are receiving a gift from someone, such as a family member, we will also need to verify their identity and source of funds. We are required to obtain this information, so please understand that we must complete this work before we can proceed with settlement. Any delay in providing this information may delay settlement.

Week 2-3: Offer and Missives

We submit your offer and negotiate the missives on your behalf. In a straightforward case with a motivated seller, missives can conclude within days. If there are multiple competing offers or complex negotiations, this may take longer. We will report to you at each stage in the process.

Week 3-6: Due Diligence

In parallel with the missives process, we conduct an inspection of the title to the property, review the property searches, liaise with your mortgage lender, and investigate any issues that arise. We raise any queries with the seller’s solicitor and report to you on the title. We also prepare the disposition and send it to the seller’s solicitor. Once signed by the seller, this deed will transfer ownership of the property to you following settlement.

Week 7-8: Settlement Preparation

If you are obtaining a mortgage to assist your purchase, we will prepare the Standard Security document for your signature. The Standard Security allows the lender to repossess and sell the property if you fail to repay your mortgage or otherwise breach your loan terms. When we are satisfied that the title is in order and all our enquiries have been satisfactorily answered, we will arrange to settle with the seller’s solicitor on the Date of Entry.

Week 8-10: Settlement and Beyond

We will order your mortgage funds to arrive shortly before the entry date and add them to your deposit. On the Date of Entry, we will send the purchase price to the seller’s solicitor. In exchange, they will authorise the release of the keys to you. They will then send us the title and the signed disposition. We will deal with any LBTT payable and register the disposition in the Land Register. This will complete your legal ownership of the property.

Please note: This timeline is indicative only. Transactions can progress very quickly and settle within a couple of weeks, whilst others are complex and complicated and can take many months to settle.

Take the Next Step

Ready to buy your next home in Scotland? Whether you’ve already found your dream property in Kirkcaldy or are just starting to explore homes across Fife, Fords Daly Legal is here to help.

Contact us today to discuss your house purchase and receive a clear, no-obligation quote for our conveyancing services.

📞 Call our Kirkcaldy office

✉️ Email us with your enquiry

🏢 Visit us in person for a consultation

The sooner you instruct us, the sooner we can prepare your offer and help you secure your new home.

Frequently Asked Questions About Buying a House in Scotland

Do I need a solicitor before making an offer on a house in Scotland?

Yes. In Scotland, only a solicitor can submit a formal offer on your behalf. Estate agents cannot issue a written acceptance of your offer. Whilst the seller’s estate agent can confirm your offer is acceptable to the seller, this isn’t binding. You should instruct a solicitor as soon as you start seriously viewing properties in Kirkcaldy, Fife or elsewhere, so you’re ready to act quickly when you find the right home. The Scottish property market can move fast, and having your solicitor already instructed gives you a competitive advantage.

What is a Home Report, and do I need one when buying?

A Home Report is a standard set of documents that sellers in Scotland must provide before marketing their property. It includes a property survey, an energy performance certificate, and a property questionnaire. As a buyer, you don’t commission the Home Report – the seller provides it.

Is a verbal offer legally binding in Scotland?

No. Verbal offers or “notes of interest” are not legally binding. Only once written missives are formally concluded between solicitors does a binding contract exist. Until that point, either party can withdraw without legal penalty. This is why it’s crucial to progress missives as quickly as possible once your offer has been verbally accepted.

What happens if the seller withdraws before missives conclude?

If the seller withdraws before missives are concluded, you have no legal recourse to force the sale through. This is one of the risks in the Scottish system during the missives negotiation period. However, once missives are concluded, the contract is binding, and the seller cannot withdraw without being in breach of contract. Your solicitor will work to conclude missives as quickly as possible to eliminate this risk.

Can I make an offer subject to selling my own property?

Yes. You can make your offer contingent on the successful sale of your current home. This is called making an offer “subject to conclusion of missives on your sale.” However, be aware that conditional offers are less attractive to sellers, and you may face competition from buyers who don’t have properties to sell. Your solicitor can advise on the best strategy for your circumstances.

What is gazumping, and can it happen in Scotland?

Gazumping (when a seller accepts a higher offer after accepting yours) is much less common in Scotland than in England because contracts in Scotland are binding sooner. Once missives are concluded in Scotland, the contract is legally binding on both parties. However, before missives conclude, sellers can technically accept a higher offer. Working with an experienced solicitor to conclude missives quickly significantly reduces this risk.

How long does it usually take to buy a house in Scotland?

Most property purchases in Kirkcaldy, Fife, and across Scotland are completed within 8-12 weeks from the date of acceptance of the offer to the Date of Entry. However, timescales vary based on the complexity of your transaction, whether you’re part of a chain, how quickly the conveyancing can be conducted, and mortgage processing times. Cash purchases with no chain can sometimes complete in as little as 4-6 weeks, while complex transactions may take 3-4 months.

Can I view the title deeds before making an offer?

Most properties in Scotland are now registered in the Land Register, and title information is publicly available. In complex transactions, your solicitor can usually review the title before you make an offer, which is advisable for complex properties or those with obvious potential issues. However, in a fast-moving market, buyers often make offers based on the Home Report and a physical viewing, with the solicitor conducting full title due diligence after the offer is accepted but before missives conclude.

What is LBTT, and how much will I pay?

LBTT (Land and Buildings Transaction Tax) is Scotland’s property purchase tax, replacing the old stamp duty. It’s calculated on a progressive scale:

- 0% on the first £145,000

- 2% on the portion between £145,001-£250,000

- 5% on the portion between £250,001-£325,000

- 10% on the portion between £325,001-£750,000

- 2% on amounts over £750,000

First-time buyers benefit from relief on properties up to £175,000. Additional properties attract a 6% surcharge on the entire purchase price. Your solicitor calculates the exact LBTT due and arranges payment to Revenue Scotland.

What if something goes wrong between the conclusion of missives and settlement?

Once missives are concluded, you’re legally committed to buy the property even if circumstances change. However, the contract typically includes conditions that protect both parties. For example, the property must be handed over in the same condition as when the missives were concluded. If significant damage occurs (say, a fire), remedies are usually built into the contract.

Related Residential Property Services

- Selling a House in Scotland – Planning to sell? We handle the legal process for sellers throughout Fife

- Residential Estate Agency – Marketing your property to find the right buyer at the best price

- Re-mortgaging Your Property – Switching your mortgage or releasing equity from your Kirkcaldy or Fife home

- Transfer of Title – Adding or removing someone from your property title

- Discharging a Security – Removing a mortgage or secured loan from your title after repayment